german tax calculator married

If the spouse died after the end of 2011 the widow or widower can still be classified in the tax class III band. About the income tax tarif 32a.

![]()

Cointracking Crypto Tax Calculator

For married or registered couples where both partners earn roughly the same money ie.

. Our German tax calculator is free to use and will give you an instant tax refund estimation. Married couples can double that sum. Under joint tax filing in Germany the income of the spousescivil partners is determined separately but then added together and submitted to the tax office as a joint income tax return.

Gross Net Calculator 2022 of the German Wage Tax System. Motor vehicle tax calculator. Your respective tax office will assign you a tax bracket.

Just ring us through and we will call you back as soon as possible. An employee with an yearly income of 9744 wont have to pay income tax for married employees the limitation will be 19488. Financial Facts About Germany.

Your employer pays half of it. Both are considered as one tax-paying unit and receive a joint tax assessment. 2022 2021 and earlier.

In addition to this the municipal trade tax is added at the rate ranging between 14 and. Income more than 58597 euros gets taxed with the highest. The basic principal is that income is divided between couples to calculate income tax liability.

For 2018 it is 7428 or 3714. 420 234 261 904. The married couple must have resided together in Germany up until that point in time.

The so-called rich tax Reichensteuer of 45. Resulting in the same monhtly tax payments as under tax class I. Online Calculators for German Taxes.

This report is called Anlage EÜR in German. This will generate your estimated amount for your Profit and Loss statement. Whether its a diesel petrol or electric car motorcycle truck or camper.

Without a progression reservation the tax for an income of 26000 Euro would be only 4333 Euro. The following applies to income tax 2013 for widowed persons. Our operators speak English Czech and Slovak.

Married couple with two dependent children under age 18 years. For example an employer can calculate an employees income tax Lohnsteuer by means of the tax brackets. 2021 German Tax rates at a glance.

After this sum every euro you earn will be taxed with a higher percentage. In return the income tax would amount to 6198 Euro which corresponds to a tax rate of 194 percent. As mentioned before you can only change your tax bracket Steuerklasse once a year.

Your taxable income is 32842. Submit your German tax return no tax knowledge needed simple interview questions helpful tips maximize your tax refund. Married couples can double that sum.

The average monthly net salary in Germany is around 2 400 EUR with a. The chart below will automatically visualise your estimated net and gross income. Income from 57919 to 274613.

First add your freelancer income and business expenses to the calculator. You only pay income tax on your taxable income. The calculator below can help estimate the financial impact of filing a joint tax return as a married couple as opposed to filing separately as singles based on 2022 federal income tax brackets and data specific to the United States.

TAX BRACKETS Steuerklassen There are 6 tax brackets Steuerklassen in Germany. 2021 every single-parent or married couple receives having a child under 25 - still in professional training living in GermanyEU and which is normally more favourable then the lump sum 8388. These figures place Germany on the 12th place in the list of European countries by average wage.

For 2017 it is 7356 or 3678. You can calculate corporation tax online using the German Corporation Tax Calculator. This sum rises in 2014 to 8354 EUR.

For married or registered couples where the partner earns less than 40 of the family income. The champaign tax was introduced by the German Empire to finance the Navy. The maximum tax rate in Germany is 42 per cent.

Income up to 9984 euros in 2022 is tax-free Grundfreibetrag. In addition the tax bracket Steuerklasse can only be changed again in the following cases. Integrated optimization checks a live tax refund calculator Check out our tax tool for free Get started.

Donations of EUR 250. Unemployment insurance costs 24 of your gross income up to 1944 year. Married dual earners can apply for the tax class IV.

It starts with 14 when you earn 8130 EUR plus 100 EUR. The request must be submitted by latest the 30th of November at your respective tax office. Start tax class calculator for married couples.

Geometrically progressive rates start at 14 and rise to 42. This is a sample tax calculation for the year 2021. Germany is not considered expensive compared to other European countries the prices of food and housing.

Here are the most important features of Ehegattensplitting joint tax assessment. Marriage has significant financial implications for the individuals involved including its impact on taxation. Use a tax return online software.

Usually within 24 hours. But for parents with a total income above 69027. Rental income from German sources of one spouse totals a loss of EUR 5000.

Are you married with tax class IIIV. With our calculator for motor vehicle taxes you know before buying how tax is due for your new vehicle. Income from 9744 to 57918.

For assistance in other languages contact us via e-mail infoneotaxeu. As you may imagine not every citizen is in the same tax bracket. A flat corporate income tax rate is 15 plus a surtax of 55 applies to the resident and non-resident companies on the profits after the deduction of business expenses.

A spouse starts a new job after they were unemployed Death of a spouse. With this tax rate however only the income without parental allowance is taxed so that the tax amounts to 5044 Euro. One earns 59 and the other 41 or it is 5050.

Income from 0 to 9744. Amount of tax credit. Financial Facts About Germany.

The average monthly net salary in Germany is around 2 400 EUR with a minimum income of 1 100 EUR per month. Its your gross income minus health insurance public pension and unemployment insurance and other contributions. Starts at a marginal rate of 14 and progressively increases to 42.

It is a progressive tax ranging from 14 to 42. Church tax of EUR 1205 wage church tax. This is recommended if both.

Income more than 58597 euros gets taxed with the highest income tax rate of 42. The child allowance for 2019 is 7620 for a joint tax return or 3810 per parent. Then add your private expenses to calculate your taxable income.

As you can see above the tax allowance is double for a married person. Note 1 on 2022 German Income Tax Tables.

German Wage Tax Calculator Expat Tax

What Are Marriage Penalties And Bonuses Tax Policy Center

German Income Tax Calculator Expat Tax

80 000 After Tax Us Breakdown June 2022 Incomeaftertax Com

German Income Tax Calculator Expat Tax

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Income Tax Einkommenssteuer Ww Kn Steuerberater Fur Den Mittelstand Ww Kn

Excel Formula Income Tax Bracket Calculation Exceljet

German Tax Calculator Easily Work Out Your Net Salary Youtube

![]()

Cointracking Crypto Tax Calculator

Salary Calculator Germany Income Tax Calculator 2022

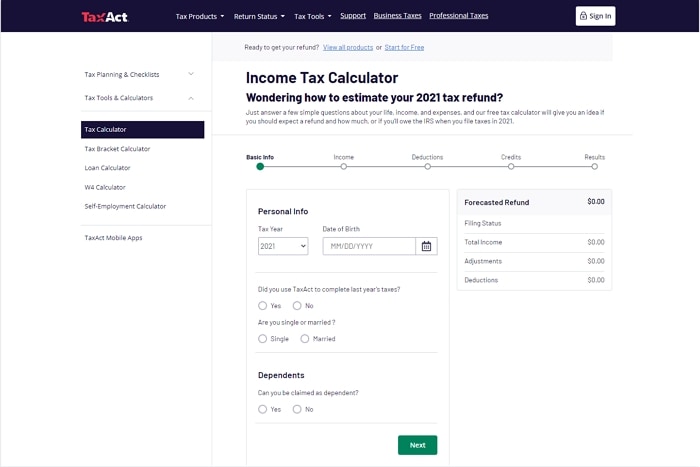

Top 5 Tax Refund Calculators To Ease Tax Refund Estimate Process